For those who don’t know me, there is something you should know. I love to share what I am reading with others, almost as much as I love reading. Lately I have been reading Maybe You Should Talk to Someone by Lori Gottlieb.

The read lends to self-reflection. A chapter that I found especially illuminating was the chapter titled “How Humans Change”. I have always had difficulty being patient with myself and others when it comes to the broken-record refrain of plans and intent to make big life changes.

This chapter in Gottlieb’s book walks us through the stages of change using one of her clients as a case study. This provided me with insight and understanding into the process of what it takes to navigate the process and actually make such changes- not only for others, but also for myself.

In this post, I will share my own case study in the process of change using myself as an example. Here, I share my own journey through the stages of change around the way I spend and interact with money and my personal finances.

Pre-Contemplation-

The first stage of change is pre-contemplation. Pre-contemplation is the stage you are in when you do not yet realize that you are in a stage of change. In this stage, you are not even considering change. If anything, you might observe that you behave in one way, and other people behave in other ways. Yet, you have no conscious thoughts or desire to change the way you behave.

My experience in pre-contemplation is, not surprisingly, not very easy to recall. It would likely be easier for someone from the outside to remember and describe. I imagine I was spending money as it came in. Starbucks, takeout, the occasional shopping spree. I wouldn’t go as far as to say the money was “burning a hole in my pocket”, but I think it is probably accurate to say that I was more comfortable- or at least used to – not having much money in my account than I was to having a large chunk sum.

I was good at being broke, comfortable being broke. And, isn’t that the romanticized idea of your early 20’s? Broke college student, eating Ramen and cheese sandwiches?

Attending college in Chicago, I had the opportunity to explore different neighborhoods. I was drawn to neighborhoods that others warned me to “be careful” in. Professors, friends and others would say things like “Don’t go after dark” and “Never go alone”. I never listened. I was drawn to these neighborhoods and their communities, not because of my natural tendency for rebellion, but because these neighborhoods felt like communities in a way others didn’t. They felt real – much realer than the crowds of distracted, self-consumed individuals that would commute through the more wealthy neighborhoods where I studied and lived.

These neighborhoods where I often went to “volunteer” and “serve” gave me much more than I ever gave to them. This confirmed to me that it was better to be “broke” in terms of bank balance, but rich in spirit and community than it is to be “wealthy” on paper, but lacking in community and authentic relationships. With this, I signed up for opportunities to immerse myself even deeper into such communities. When it came time to graduate, I applied for Teach for America where I would have the opportunity to become a part of the very types of communities I loved. And I did. I went from the idealized “broke college student” straight into a (still broke) Mississippi Hippie, determined to fill my life with meaning and purpose, not money or materialistic items.

To this day, the time I spent living, teaching and learning in Marks and Lambert Mississippi are some of my fondest memories. Even the hard parts- and there were plenty of hard parts- were made better by the realness, love, generosity and authenticity of the local community that I had the opportunity to become a part of. These experiences confirmed to me that there is so much more to life than collecting coins like some Super Mario Bros game.

I had help in maintaining these ideas around money and wealth. Any time I might hear about a friend setting up a company 401K or think about how much I would need to make to actually pay back my student loans, I would be brought back to my calling, my meaning- much deeper than company match, compound interest and credit scores. Teach For America seemed to thrive on a sort of organizational language that included refrains like “We aren’t in it for the income, we are in it for the outcome”. While I rolled my eyes at much of Teach for America’s “culture building”, this motto stuck with me. It fit, so I wore it- proudly.

There is much more behind the money scripts and money stories that contributed to my money psychology than would fit in this post, and I look forward to diving into them throughout this blog, but for now it is enough to know that these ideals and identities largely defined the pre-contemplation stage of my money journey.

Contemplation-

The next stage, contemplation, is where an individual becomes aware of the possibility that there are behaviors, thinking patterns or other aspects of their life that they might want to consider making a change in. In this stage, they begin considering what it would mean to make such a change.

Often an inciting incident pushes people out of pre-contemplation and into the next stage, contemplation. For me, it was a phone call – or many, many phone calls.

Those phone calls? You guessed it. The banks and lenders wanted their money – my purpose and “meaningful work” be damned.

At this point, my debt had begun to rack up. I had student loans that I had taken out to get my Bachelor’s degree. These loans were to the tune of somewhere around $22,000. Due to my “service” in Teach for America, I didn’t have to make payments on them at the time, but that didn’t stop them from earning interest as I breathed. The lack of need for payments fed into my denial of the situation. A problem for “Future Me” and Future Me would be much better equipped to handle things like this. Current Me was busy teaching kids, making friends and dancing barefoot in the rain.

In addition to the student loans, I had just taken out an additional loan (around $3,000) in order to participate in Teach For America. Since I had just graduated from being a broke college student, I had no capital leaving college. I couldn’t afford the teacher training tuition or room and board required for the summer training program, so Teach for America generously offered me a loan. I’m not saying Pyramid Scheme, but…

And then there was more, do you know what else you need to live in the rural Mississippi Delta that I did not have when I left my Chicago college experience ? A car. Since this car was going to need to transport me not only across miles and miles of rural country highway each day commuting to and from school, but also back and forth between Mississippi and Wisconsin at least 3 times a year, a $1000 junker -Dave Ramsey style- wasn’t gonna cut it. So, another loan it would be- this one about $17,000. Here I was, just under $50,000 in debt before the age of 25. Killing it!

The thing is, I was paying on these debts, paying my bills- for the most part. Although I didn’t have to pay on the school loans, I was aware of the fact that interest was accruing and didn’t want to be paying them forever, so I began making my monthly minimum payments…sometimes. I was also making my car payments. I just didn’t always make these payments on time…

My finances were a bit of a mess, as might happen when you are a self-proclaimed “Mississippi Hippie” who can’t be bothered with details and deadlines and paperwork. Especially when the paperwork is purposefully and unnecessarily complicated. The Teach For America loan for instance, no idea how or where to pay it. When I asked, they informed me that I didn’t have to pay on it until after the program (or something like that). So, I just let it go and moved on to the next thing. After all, I was busy, and surely Future Me would know how to handle it.

For now, Teach For America wanted their data, the school wanted more data along with a bunch of other paperwork, and I just wanted to “grow the babies”- more Teach For America nonsense- and escape every weekend to the nearest city with a Starbucks, so I could get some real espresso in my veins after getting by on sugared-up sweet tea during the week.

I didn’t much care, or see the big deal if Wells Fargo got their payment on the 8th (or 18th) instead of the 3rd. And the school loan, who cared? I didn’t even know what date the payment was supposed to be made on. I paid it when I paid it. They knew I was working hard and doing good work…right? Isn’t that why they had offered to defer them? The way I saw it, I was overachieving by paying on the loan at all- no matter what day of the month I sent it in, or if I missed a month when the weeks (and money) seemed to go by especially quickly.

But the banks were a little more hung up on the details… hence the phone calls.

Eventually, the debt began feeling heavy. With every ignored phone call, my stomach would knot and drop. I knew I should care, at least a little bit. And so, I would be a little better. I made the car payments on time, and tried to be intentional on making more regular payments on the school loans too. I was doing good and doing well.

But, as I quickly learned as an educator, growth isn’t linear and life happens. I had my payments figured out and was getting my debt under control(ish), when one day while I was at recess with my students I was bit by a few fire ants. Now, for most people this would be uncomfortable and unpleasant. Turns out, for me it was potentially fatal.

Having grown up in Wisconsin and never having lived in the South until my move to Mississippi, I did not know that I am apparently very allergic to fire ants. I ended up passing out and being brought to the nearest hospital (a town or two over) via ambulance. Add hospital debt to my ledger… The thing is, I would have paid that too. If they had just mailed me bills or made it clear how. But they didn’t. I told myself I didn’t have the energy, time or patience to track down people to pay money to, so I just… ignored it.

Sure, these were likely excuses. It wouldn’t have been that hard to figure out payments, and I had a great support system. My friends and roommates would have made the calls with me and helped me figure it out, but this was a perfect excuse for me to procrastinate and self-sabotage. I wasn’t sure if I was ready for change.

This is common in the contemplation stage. There are outside factors and forces that buzz, like a gnat in the individual’s ear, nagging the idea that we “should” be making a change, but we are not yet fully committed to doing so. Instead, we waver.

Being laid back, unbothered was who I was. I was Phoebe of the F.R.I.E.N.D.S group. If I was no longer the carefree, laissez faire “Mississippi Hippie” who was more concerned about the “outcome” than the balance ledger, what would that make me? Who would I become instead? Brad in accounting? I didn’t know that I wanted to be Brad. The ant bites and hospital bills were a convenient excuse, allowing me to remain the silly little mess who was just doing my d*** best…

And so, I flopped around in contemplation for a while- for a good while.

For a few years I would go back and forth between being “better” and falling back into bad habits. I always paid on bills as I was able to, but I didn’t cut back on unnecessary spending or intentionally plan out where my money would go. I didn’t make additional payments or pay more than was required on the bill, which meant paying little more than the interest due at the time. This meant I was not making much progress on the principal balance, and in the case of my school loans… I already now owed more than when I had initially started paying on them.

It was paycheck to paycheck for me. I justified it by blaming it on the -almost pathetically low- pay rates that came with my work in education and small nonprofits. It is true, this didn’t help, but neither did my lack of planning out how to make the most of that minimal income. I bounced back and forth between thoughts of “I need to get this together!” and “I deserve to have… Starbucks, Target sprees, takeout, etc… It’s not my fault our greedy capitalist system undervalues the important work I do!”. I was stuck in a cycle of ambivalence laced with indignation.

Preparation-

But, even through my ambivalence something kept poking at me like the scratchy poke of a tag on clothing that you just can’t quite seem to find the source of. I know now that the poking was this: If what I wanted was to be untethered by money and capitalistic systems, I had to become less tied to them, not more. The very things tying me to these systems were my debt and my spending. Looking back now, it is so clear, but at the time I struggled to find the source of the itchy tag.

And so, this realization lived for a while just below the surface of my conscious understanding, likely muted and kept down by the busyness that keeps us all (or most of us) underwater. Then something shifted. Maybe it was turning 25 and the benefit of a fully-developed prefrontal cortex for decision making or the months of unemployment that had me struggling to make simple payments for services like Wifi – not a good season for my student and auto debt repayment record… Whatever it was, I started making small changes- without even thinking too hard about it. I had entered into the next stage, preparation.

By fall of 2020, I had built up a few thousand dollars in an emergency fund, and I began taking in personal finance content. I was reading personal finance content created by women for women and found podcasts like Bad with Money and HerMoney. These were real people, often women, talking about the very things I was struggling with, and they were talking with compassion and understanding, not judgment or shame. I was hooked.

My exploration into the female-led personal finance community helped to solve my identity crisis. The personal finance content all provided the same message: “Smart women, empowered women take control of things, including their money. Smart women know where their dollars and cents are going. That is how smart, empowered women get good with money”. Well, I was a smart woman (at least I liked to think so), and so I no longer had to pick between the carefree, unbothered identity I had been clinging to and some unknown stuffy suit. I could lean into being a smart, empowered woman who was (getting) good with money.

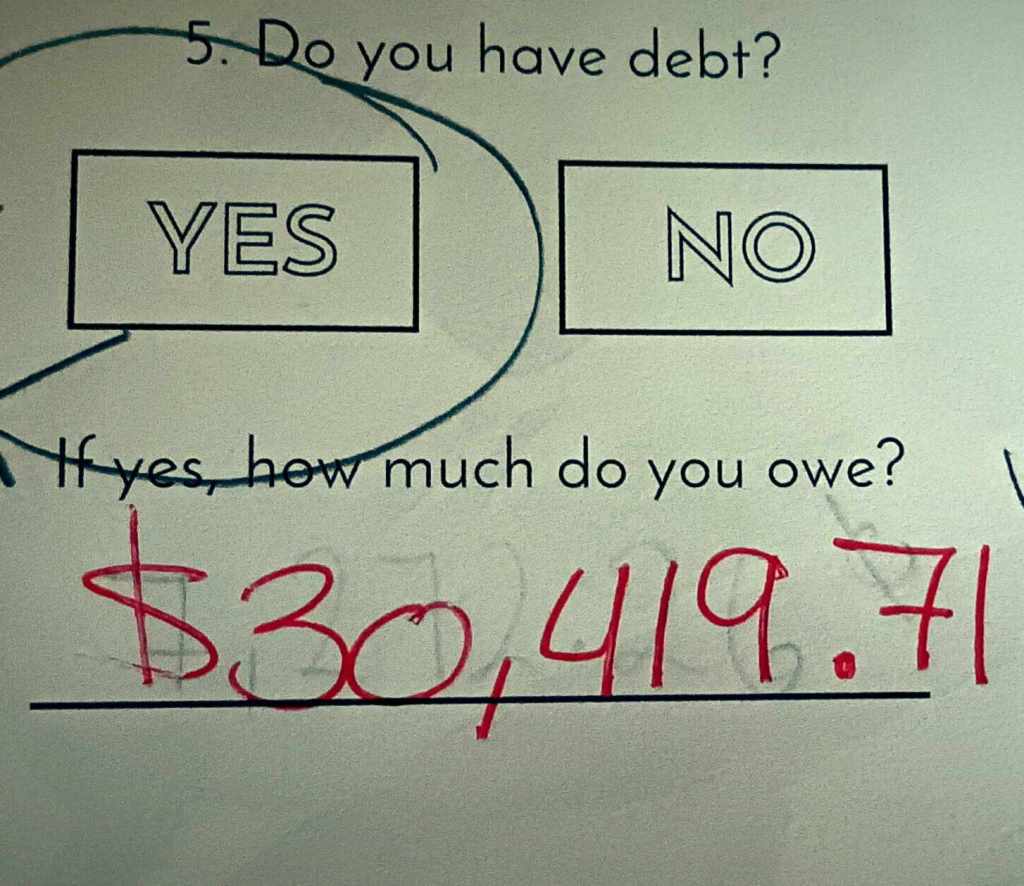

In January of 2021, I bought my first budget workbook which I still have on my personal finance shelf in my apartment. Common Cents, a budget workbook by Meleah Bowles & Elise Williams compassionately meets you where you are at and then gives you the practical tools and guidance to make changes and do the money stuff that will help get you where you want to go. The workbook sat on my shelf for a few months before I was ready to truly dive in. But by March of 2021 when the hope of spring hung in the air, I was ready for action.

Action-

I still remember that day in March. I remember the cool but sunny air, the feeling of rebirth hanging in the breeze. I came in and opened the Common Cents budget workbook. I got started. A few days later, I came in from another walk and sat down at my computer. I gathered up all my courage and logged into all my accounts to see how much I owed in total. School and car. (The Teach for America loan had been paid off by now, another story for another post. The medical debt had gotten forgiven due to circumstances, etc.).

Let me pause here to say that I relate SO hard to people who are afraid to open bills as they come in, people who stash them in folders, drawers, mail holders, mattresses or who file them directly in the circular files. That was me. That was me for SO long. I even avoided looking at the total balance when I would make my school loan payments on Nelnet. I just went in, clicked the Make a Payment and entered the minimum payment amount.

I was afraid of the number. The number that I knew was growing due to interest. Each time a new statement came, I was more afraid than the last time because I just knew it was worse than the last time. My internal dialogue went something like this:

“I was afraid of this last time, and if I had been afraid the last time it must have been because it was bad. If it was bad the last time, it will be worse now. If it was bad, and is now worse, then it must be really, really bad now because worse than bad is really, really bad. So, if I was afraid last time, I should now be terrified this time”.

Welcome to the spiraling of an anxious mind. I was terrified of knowing and was paralyzed by the terror, the terror I had built up in my own mind.

But that day when I looked it all up, and wrote it all down, something magic happened.

That day, when it was all written down in front of me, scratched out on envelopes and scraps of bills and then officially recorded into the workbook, I was no longer afraid. I could breathe lighter. I had “The Knowing”. I had a goal post. With a goal post, I could come up with a plan -I believe us educators call it “backwards planning”. With a plan, I could intentionally determine the next right action, and the next after that…until I reached the goal post.

Maintenance-

And I did. I reached the goal post. That day as I scribbled down the number $30,419.71, I set the goal to pay it all off, to be done with it once and for all and to be debt free by age 30.

This past August- August 27th 2023 to be exact, four days before interest resumed on my student loans (still got a bit of that Mississippi Hippie in me)- I made a final, lump sum payment on my student loans. I waited a few days for processing. Then I sat there refreshing the Nelnet page reading and re-reading the words “paid in full”. I said them out loud. “Paid In Full”. Then I said it again and a few more times in celebration. That was it. My debts, the ones that had hung over me for so long were now… PAID IN FULL. I was debt free.

There were definite actions that went into this goal achievement, and I plan to continue sharing those through his blog and my associated Instagram @spentmillennial. Here, I will summarize it as a lot of reflection, intention, discipline and determination. These actions of change earned me so much more than the label “debt free”. It showed me how to live and spend in my values while staying within my means.

Writing this just about one week from my 30th birthday (October 11,2023), I do feel lighter. I feel accomplished. I feel content. I feel secure in a way I never could while holding the debt. But with that contentment and security, I recognize that I am now in the 5th stage- maintenance.

In this stage, it is critical to maintain the change for a significant amount of time, and when it comes to financial security- as with all growth- I also cannot stop here. I need to make continued progress. There is still much I need to address and conquer to remain financially secure. Things as seemingly complicated as retirement accounts and long-term health planning (HSA or otherwise) as well as those as seemingly simple as continuing to live within my means. That is the journey I am on. I am confident that I can travel it- if not with grace and ease, at least with vigor and personality. It is this journey that will make up my maintenance stage.

In part, maintenance is what this blog and the associated Instagram is for. It is to create accountability and community to keep me doing the actions that got me this far while leveling up to get to the next level of financial security and freedom, and the one after that, and after that…

So, while I wish to share my experiences with others to provide community -and possibly some resources -for others, I also write, share, create and exist in this community for myself. It is a reminder of where I started, how far I have gotten and where I aim to go- because in a world filled with a million distractions a minute, sometimes you need a community to ground you.

Thank you for joining me on this journey, in this community- however and whenever you decide to show up. I’m glad you are here.

For deeper connection with the community please follow and reach out to me on Instagram @spentmillennial.

If you have a change you are in the process of or a money story you would like to share or connect on, I would absolutely LOVE it if you would share it by tagging @spentmillennial on Instagram or emailing it to hello@spentmillennial.com.

Leave a comment