This week, while getting ready for work, my partner sent me a Zillow listing, and I fell in love immediately. I was ready to pack up and move that morning. As I clicked the link, my post-run shower and mental to-do list for the day vanished. Never mind that the house was in another state, we couldn’t afford the down payment, and our lease had just renewed two months ago. Even the fact that I didn’t like the bathroom slipped my mind. All I saw was land, water, and a picture of a nearby bridge—and I was in. Move to my newly-discovered dream house, figure out the details later.

I’ve always been the type to jump headfirst into new possibilities, ready to pack up and start fresh. I like to think it’s part of my charm. But this same impulsiveness got me into financial trouble in my early twenties, leading to years of scrimping and sacrificing in my late twenties to dig myself out of debt.

Luckily, my partner is more level-headed. While I dream with abandon, he dreams with prudence. He sends Zillow listings, but with a firm eye on our budget and long-term goals. He’s been instrumental in helping me embrace the long game—how to dream big but plan smart, like working toward a house with land, water, and yes, even an ugly bathroom we’ll have to fix later.

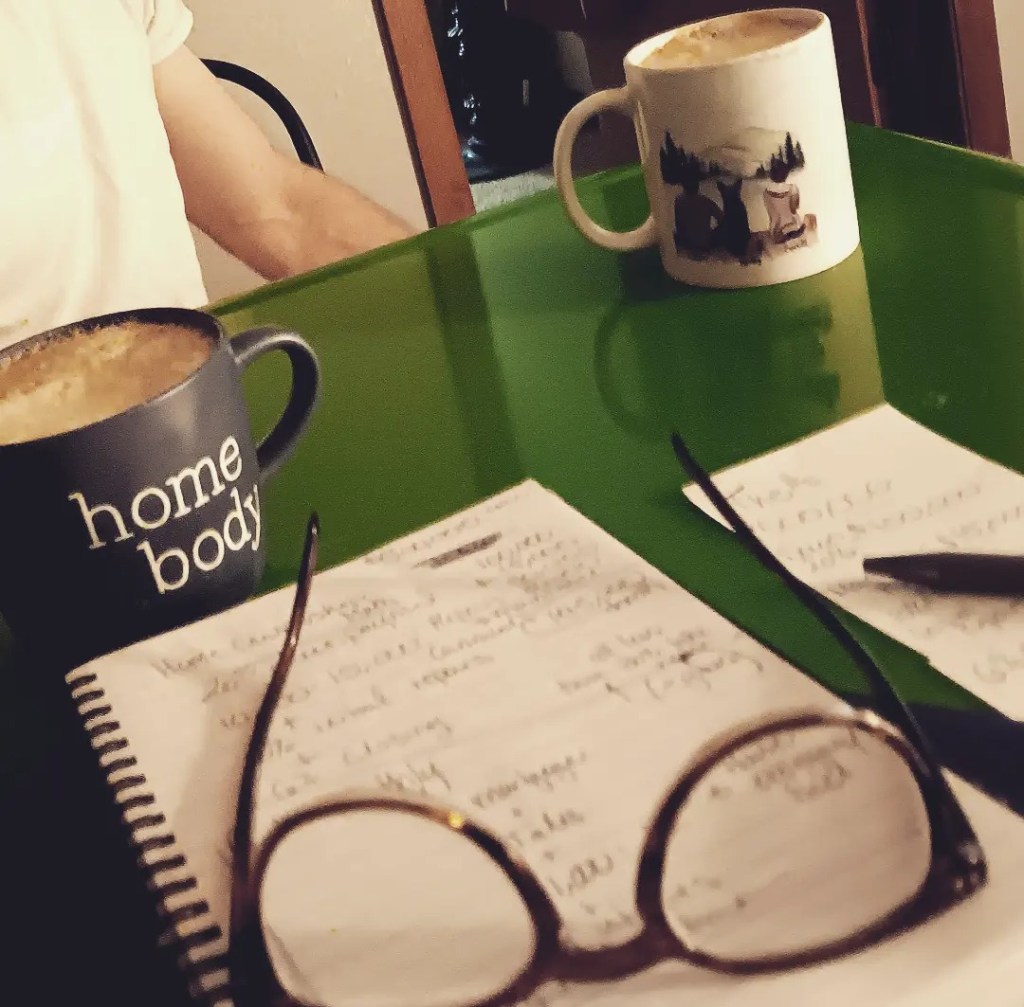

A year ago this week, we sat down for a “money date” and got serious. We broke down the numbers and timelines of what it would take to buy a house—down payments, phantom costs like repairs and renovations, property taxes, and all those expenses no one warns you about when they tell you to stop “throwing money away on rent.”

We figured out what we wanted our income-to-housing-cost ratio to be and mapped out what it would take to get there. I won’t bore you with all the details, but we did the work. We set a target savings goal and track our progress every month, checking in to celebrate each small milestone. Some months, the growth feels slow, but we remind each other we’re doing great whenever we need it—whether that’s after seeing yet another “New Homeowner!” post on social media or when we have to haul our neighbors’ cold, wet laundry out of the shared washing machines.

We’ve come a long way, though. Since paying off debt and making strides in our careers, we’ve been able to loosen the purse strings a bit. There’s a sense of relief in not having to scrutinize every single purchase, but even as we enjoy a little more freedom, we stick to our budget with our long-term plans in mind. At times it’s tempting to throw it all out the window and “do it for the plot”—like when that dream house popped up—but we’ve worked hard to stay grounded and focused. We have seen the ‘buried in bills and mortgage payment stress’ storyline played out enough. Our goal is clear: a home of our own, on our terms. While we aren’t delusional enough to think we can plan everything perfectly or avoid any drama– what fun would that be anyway-, we have committed to doing our part to plan for what we can and let the rest be the adventure that awaits.

In the meanwhile, we’ve gotten good at balancing celebration with discipline. It’s not always glamorous, but there’s a deep satisfaction in seeing our savings grow, in knowing we’re working toward something big. When we feel the pinch of sticking to the plan or catch ourselves getting a little too impatient, we remind each other why we’re doing this. It’s for the payoff down the road, for the sense of peace that comes with knowing we’re building something sustainable.

When our money date social media post popped up in my memories, I shared it with him as a reminder of how far we’ve come. Tonight, as I sit in a local café with an iced chai, walking distance from our humble apartment (where we’ll be staying for the next little while as we work our plan), I called him to meet me at the Mexican restaurant next door. We’ve earned a guilt-free, spur-of-the-moment dinner to celebrate our progress and the peace that comes with planning for the future.

Leave a comment