Confession: My Spending Has Been a Bit of a Mess Lately

Let’s start with the truth—my spending habits have been all over the place recently. After a period of really tight budgeting and focused financial goals, things have shifted, and I’ve found myself navigating a new kind of challenge: financial flexibility. While that sounds great (and trust me, in many ways it is!), it’s been a bit harder to manage than I expected.

So, let’s back up a bit. My finances have changed a lot over the past few months. I’ve paid off my debt, which was a huge goal for me, and I’m now more focused on saving and investing. The relief of not being weighed down by debt is freeing, and it’s allowed me to start thinking about long-term goals like building retirement savings and some day buying a house. And with my recent job change, I’ve got new income and benefits that give me even more room in my budget.

So, what’s the problem? I see you rolling your eyes and muttering to yourself how you would love to have such ‘problems’. And trust me, I get it. But there are challenges that come when you shift from being in the mindset of “no, I can’t afford that” for so long. It’s surprisingly tough to switch gears and find balance. Before, it was easy to stick to a strict budget because the answer to “can I afford this?” was almost always “no.” I didn’t have to think about it too much—necessities like groceries and bills took priority, and there wasn’t much wiggle room for anything else. And I felt pride it it and excitement knowing what it was working towards.

But now? Now I can say “yes” to some things. And that’s where it gets tricky. I have more flexibility, but that also means I need to exercise new muscles when it comes to managing my spending. Just because I can say “yes” doesn’t mean I should every time. This shift has been both exciting and a little overwhelming. It’s not just about having more money to spend; it’s about learning to set new boundaries for myself and practice discipline in this new phase of financial freedom.

That’s why I decided to develop a new system for myself—a budget and spending tracker to keep everything in check. I’ve always responded well to goals, and I know that I’m much more disciplined when I have specific targets and markers to hit. This tracker is designed to do exactly that.

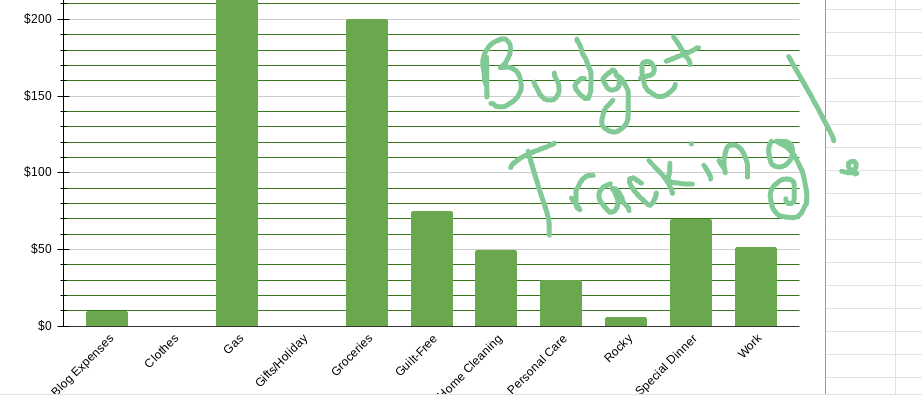

Here’s how it works: each week, I enter my spending into the tool, and it breaks everything down by category—groceries, dining out, entertainment, savings, and so on. At a quick glance, I can see how much I’ve spent in each category and how much room I have left in my budget. Since I’m a very visual person, I linked the data to a bar graph, so I can easily track where I’m at. The idea is that the visual cues will help me stay on top of my spending before I hit that “oops, I’ve gone too far” point.

I’m really hoping this tool keeps me disciplined and on track this month. The process of creating it has already helped me feel more in control, and I’m excited to see how it plays out in practice. If you’re curious, you can check out the tracker I created here , and I’d love to hear your thoughts on it! (You may need to adjust the spending categories to fit your life.)

Do you have any challenges when it comes to sticking to your budget or spending plans? What tips or tools do you use to stay on track? Let me know in the comments—I’m always looking for new ideas and inspiration to keep my financial goals moving forward!

Leave a comment